10 Dec 2014

Risk weighted assets: a journey of improvement

Among the various issues highlighted by the Financial System Inquiry (FSI) was the calculation of banks’ risk-weighted assets (RWA). As the basis for banks’ regulatory capital requirements, this is a central measure in investors’ assessment of a bank’s balance sheet strength, as well as influencing bank pricing and shareholders’ returns.

Any discussion of capital must include a discussion of risk weighting.

"Any discussion of capital must include a discussion of risk weighting."

Brad Carr, Senior adviser at the Institute of International Finance

While the FSI’s recommendations focused specifically on the risk weightings applied to Australian mortgages there is a broader ongoing debate on the global stage around the future of risk weighting and its place within the broader Basel framework.

Banks take on risk, trade risk, price it, manage it and ultimately generate a return to investors who take a share in that risk. It would seem appropriate capital requirements are sensitive to the relative riskiness of each bank’s underlying portfolio of assets. However, some commentators have advocated more simplified approaches for calculating banks’ capital needs.

The BASEL journey

Established in 1988, Basel I structured RWA according to counterparty-type: corporate loans were risk-weighted at 100 per cent, mortgages at 50 per cent, exposures to other banks at 20 per cent and sovereigns at 0 per cent.

This regime was both simple and blunt, with no distinction for the risk characteristics of the individual borrower. It created arbitrages under which banks were incentivised to sell down their low-risk corporate assets whilst maintaining weaker corporates on their own balance sheets.

Basel II was implemented in Australia and Europe in 2008 (and much later in the US), introducing multiple RWA methodologies, including the Advanced (internal models) and Standardised approaches. The learnings from the financial crisis have drove Basel III, which retains the RWA approaches but also tightens up definitions of banks’ capital instruments and adds new liquidity requirements.

RWA variances between banks

Where a bank is accredited by its regulator to operate with internal models (as are the big four Australian banks and Macquarie Group), it will have many models (often hundreds) considering factors such as historical data and economic conditions to provide sophisticated measures of borrowers’ risk characteristics.

For other banks, the standardised approach preserved much of Basel I (at least for borrowers that are not externally rated by a credit rating agency), including arbitrages, though it notably reduced mortgage risk-weights from 50 per cent to 35 per cent.

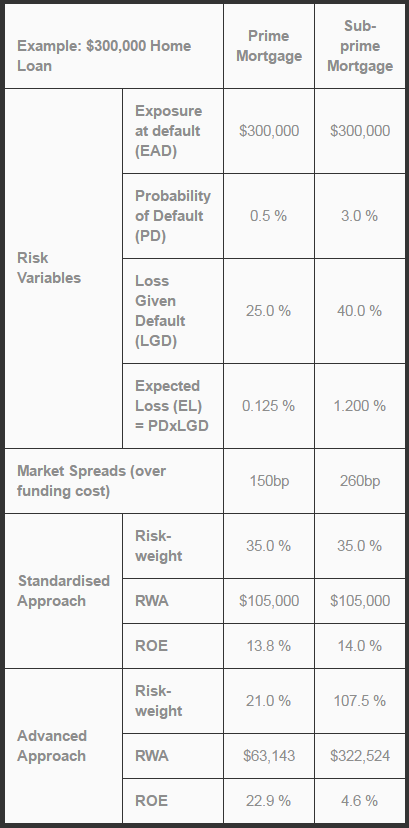

Indicative examples of RWA and Return on Equity (ROE) are shown for Prime and Sub-prime mortgages under the Standardised and Advanced approaches, as follows*:

Under the Standardised approach, RWA (and therefore required capital) is constant across both the Prime and Sub-prime segments, whilst the Sub-prime segment’s higher Expected Loss (EL) merely absorbs the higher spread. The outcome is essentially ROE-neutral.

However, using internal models under the advanced approach, the impact of the risk variables is also reflected in RWA, as per the true risk of each asset. This creates a wide ROE disparity, incentivising banks to direct their efforts towards the lower-risk segment.

Whereas banks had still operated under Basel I in the lead-up to the financial crisis, the enhanced risk-sensitivity of the Basel II Advanced approach represented a major step forward.

* The examples shown are strictly indicative, based on pooled international data, and do not represent the estimates or calculations of any individual bank.

Where banks operate internal models, there are variances generated between each bank’s models, and it is accepted that some of these variances are too large.

It also causes some consternation that two banks can calculate different RWA values, even when lending to the same borrower.

The sources of such variance between banks’ internal models come under three broad categories:

- Legitimate differences between banks, reflecting their distinct risk practices and policies; banks have different approaches (and therefore different historical data) in how they manage deteriorations in their borrowers’ creditworthiness, and in how they collect on bad debts.

- In their modelling approaches, banks have made varying assumptions, and used different parameters and inputs.

- National factors, including regulators’ requirements, consumer protection laws, and accounting treatments.

Some degree of variance between banks is therefore expected and is actually desirable; the objective should not be to eradicate all variance. If all banks were straitjacketed to a single uniform model, model risk can become a new source of systemic risk, and promote ‘herd behaviour’.

Canada’s OSFI Senior Director Richard Gresser noted recently:

“We don’t want banks to all have identical views of risk but we don’t want them to have radically different views either. We have got to recognise that there is no perfect knowledge, no single perfect view of what’s the right risk measure.”

The IIF RWA Task Force (comprising 43 banks, including 3 of the Australian majors) has made a series of proposals to harmonise modelling assumptions and parameters, so as to narrow the scope of RWA variance to just those legitimate differences.

Some critical views

There have been some well-founded criticisms of internal models, which banks need to take on board. Unfortunately, there have also been some erroneous claims – some have even sought to blame internal models for the financial crisis, notwithstanding the timeline described above.

Among these criticisms is a misconception that banks can somehow set their own capital requirements. Models are subject to robust internal and external governance and control, including strict protocols for approval by regulators.

Banks need to invest in not only developing and validating models (and proving them to their regulator’s satisfaction) but also maintaining, updating and back-testing models and driving continuous improvement.

Some contend internal models are merely an excuse for banks to be able to reduce their capital requirements, citing a 20 per cent reduction in the ratio of banks’ RWA to Total Assets from 2007 to 2013.

However, this statistic reflects banks’ selective deleveraging since the crisis, demonstrated growth in secured financing, and the accumulation of highly-rated liquid assets. As banks moved to the Basel II advanced regime, this has helped them to become more judicious in their provision of credit. They have effectively shifted their portfolios towards lower risk-rated assets and indeed, particularly in Europe, shrunk their traditional lending.

Simultaneously, banks have been actively accumulating stocks of highly-rated securities, ahead of new liquidity requirements commencing in January 2015. Over that same 2007-13 period:

- US banks’ holdings of US government obligations increased by 87.5 per cent; this increased from 7.0 per cent to 10.2 per cent of banks’ Total Assets.

- Japan’s banks increased their holdings of central government securities by 74.8 per cent, accompanied by a 45.0 per cent increase in local government securities.

- Eurozone banks’ exposures to governments increased by 41.6 per cent.

- Australia (an economy without deep markets of alternate, private liquid securities) has seen an even more pronounced impact, the four majors increasing their holdings of commonwealth and state government securities from $A13.0b to $A123.7b, an increase of 848 per cent.

This dramatic growth of highly-rated assets has materially reduced the overall average risk-weightings across the industry.

Consider the shifts in lending to consumers, towards residential first-mortgage loans ahead of unsecured credit, over that same 2007-13 period:

- US banks’ mortgage lending secured by first liens increased by 13.3 per cent, whilst those secured by second liens fell by 66.5 per cent; second-lien loans have gone from 14.1 per cent of banks’ mortgage portfolios, to just 4.6 per cent.

- Japanese mortgage lending increased by 20.6 per cent, whilst unsecured consumer lending had a small reduction of 0.7 per cent.

- Australia’s 4 majors significantly altered the composition of their Total Gross Loans and Acceptances, with owner-occupied mortgages increasing from 38.2 per cent to 43.1 per cent, whilst unsecured consumer lending in the form of credit cards and personal loans fell from 8.9 per cent to 5.4 per cent.

The pitfalls of simpler approaches

While some advocate it, a return to a simpler regime (whether via the Standardised RWA approach or greater reliance on the Leverage Ratio), would create some dangerous mis-incentives and distortions. As well as the increased systemic implications, there would be risks in pricing, in banker behaviour (via remuneration and incentives) and in adverse selection on bank lending portfolios.

APRA Executive General Manager Charles Littrell has highlighted the direct connection between capital measures and incentives, noting:

“When we set capital requirements we look at three things: adequacy, because we want to be safe; incentive, because we want to match capital to risk; and simplicity. Those in the world who love leverage ratios love them because they allegedly produce adequacy, and they are certainly simple, but they utterly fail at incentives. So we very much want to keep a risk based approach to get that incentive effect.”

In pricing transactions, banks aim to adequately compensate for risk and generate a return on their shareholder’s capital. It is highly desirable for regulatory measures and shareholder returns to be aligned, and commensurate with the risk taken.

If the level of capital required for an asset is not risk-based, banks can generate higher earnings from riskier borrowers whilst holding the same capital as if they lent to the safer borrowers (as per the above mortgage example).

The same incentive factors are critical in how banks apply performance metrics and remunerate staff, so that bankers are accountable and responsive to earning a return relative to the amount of the firm’s capital that they are putting at risk.

If capital requirements lack risk-sensitivity, this can also create the risk of adverse selection on banks’ portfolios: over-pricing credit for well-rated counterparties and under-pricing it for the more marginal borrowers could see portfolios progressively shift towards the higher-risk segment.

Even if this isn’t a conscious strategy to boost ROE, regulated banks could struggle to compete against other financiers (such as the ‘shadow-banking’ sector) for better-rated assets, thereby skewing the portfolios of the regulated sector towards weaker credits.

This is compounded by the requirements for banks to maintain large holdings of low-risk and low-yielding liquid assets (eg. government bonds). Under a flat capital measure, a rational bank optimising its ROE would seek to offset this by lending to riskier, high-yield credits, creating a ‘barbell-shaped’ portfolio, and leaving a gap of well-rated commercial and consumer borrowers for whom it might be uneconomic to service.

Some advocate the use of dual capital regimes, to apply the ‘higher of’ risk-based and flat measures of capital. As per the chart below, the effect of this is that the flat measure will become the primary constraint for the majority of a bank’s portfolio, including for the more favourable end of the credit spectrum. As well as distorting the view of credit across portfolios, this creates inefficiency in the deployment of credit across the economy.

There is a role for supplementary measures to complement the risk-sensitivity of internal models – but such should be calibrated to serve as ‘backstops’, covering for model risk (and any outlier banks), and not over-riding the risk-based approach and becoming the binding constraint on the firm’s business.

For Australian mortgages, this is noteworthy in the context of the FSI’s recommendation to raise the 4 majors’ risk-weights. It is encouraging that the FSI’s report repeatedly recognises the importance of risk-sensitivity, and of ensuring that banks are incentivised to improve their risk management – but it remains to be seen whether this recommendation would be pursued via the introduction of a new (flat capital) floor, or some other mechanism.

The way forward: models must be improved, not abandoned

Banks and regulators have made great progress along the Basel journey, in improving the sophistication of risk management and using risk-return metrics to promote a proactive risk culture at the point of origination. The debate around the ‘future of RWA’ puts the progress banks and regulators have around being pro-active on risk on something of a knife-edge.

The framework for internal models does need to be improved, with the IIF RWA Task Force’s proposals to harmonise modelling inputs and assumptions, and to increase the transparency of banks’ RWA calculations. The increased focus on regulatory stress testing can help complement this.

Regulators’ strict governance of banks’ models must be maintained, empowered with not only the legal right to deny (or withdraw) a model’s approval but also the resources to make that assessment. As Bank of England Deputy Governor Andrew Bailey noted:

“To use models and stress tests effectively requires intensive development and maintenance by firms and a highly skilled body of supervisors and a regime where judgment can be used. It also requires the supervisor to have a credible capacity to withdraw the permission given to a firm to use a particular model if the model is considered to be inadequate or the firm has not demonstrated the capacity to use it safely.”

Banks and regulators need to continue this journey, to ensure that a risk-sensitivity approach is further embedded as the basis for which banks price credit and make strategic decisions, and individual bankers are remunerated.

Risk-sensitivity in the banking system is an essential economic good. Where it is not perfect, it must be improved, not abandoned.

Brad Carr is a senior adviser at the Institute of International Finance.

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.