01 Jul 2019

Global trade: the war clouds darken

Australia is in an undeniably a fraught situation with the China-America trade war.

The Australian Trade Minister Simon Birmingham was in Beijing earlier this month effectively playing hopscotch between Australia’s critical economic ties with China and its security partnership with the United States.

“A slowing economy in a softening global environment is one thing; Australian’s long term security in a world that is changing before our eyes is another.”

Juxtaposing Birmingham’s visit to the Chinese capital with the presence in Australia of hawkish US officials, Secretary of State Mike Pompeo and Defence Secretary Mark Esper, illustrates Australia’s security and economic dilemma.

While Pompeo and Esper, as part of AUSMIN talks (Australian-US Ministerial), were urging Australia to toughen its approach to China, Birmingham was in Beijing attempting to assuage the Chinese on a range of trade issues - including interruptions to Australian thermal coal imports.

Wedged between its security guarantor and its economic lifeline, Australia finds itself in what the Chinese would describe in the language of the Marxist dialectic as a “contradiction’’.

Trade talks

China has not provided a satisfactory explanation for delays in offloading Australian coal but it is reasonable to speculate that stresses between Beijing and Canberra are a factor.

The coal go-slow is precisely how China makes its displeasure known more broadly.

“I will be seeking to better understand the additional checks and safeguards that are being applied around thermal coal. How our businesses can get clarity as to what those checks are, how long it takes to clear Customs processes,’’ Birmingham told reporters in Beijing.

Australia’s coal exports to China in 2018, both thermal and coking, totaled $AU14.3 billion.

In Beijing primarily for talks on advancing a Regional Comprehensive Economic Partnership (RCEP) - a proposed grouping of 15 Indo-Pacific trading nations - the Trade Minister did not have a formal meeting with Chinese counterpart, Commerce Minister Zhong San.

They met on the margins of the RCEP talks. More pointedly, China has not welcomed an Australian prime ministerial visit in three years.

This is one of the longest hiatuses in visits by a prime minister since Gough Whitlam normalised relations with the People’s Republic in 1972.

In Beijing, Birmingham did his best to mollify Chinese concerns over what has been perceived to be hostile attitudes in Canberra on issues like technology giant Huawei’s access to Australia’s 5G network.

For example, he appeared to take China’s side over a proposed US tariff hike in a television interview: “the application of those sorts of unilateral tariff actions is not something we have welcomed and it may well be a breach of World Trade Organisation rules, but that is something for an independent process.’’

Frosty reception

It’s not clear this is cutting much ice.

Beijing will not have overlooked the role played by Australian officials in lobbying other members of the so-called “five eyes’’ collective intelligence sharing grouping Australia, Canada, the United States, Britain and New Zealand to exclude Huawei from their 5G networks.

On top of all this, Birmingham’s trade mission coincided with a further escalation in a US-China trade war prompted by President Donald Trump’s threat to slap 10 percent tariffs on $US300 billion worth of Chinese imports from September 1. The US already has in place tariffs of up to 25 percent on $US250 billion of Chinese imports.

China’s retaliation in the form of a competitive currency devaluation that breached the seven yuan to the dollar benchmark further elevated trade tensions made worse when the US branded China a “currency manipulator’’ – despite experts pointing out this was not the case.

Moreover, Trump has explicitly called for the US to manipulate its currency.

The risk is not simply a tit-for-tat trade war between the US and China but much wider fallout in which competing trading nations devalue their currencies to maintain competitiveness.

Competitive devaluations on the back of an already de-stabilised global trading environment are the last thing the world needs at a moment when global growth is slowing and uncertainties persist over the sustainability of both America’s and China’s economic expansions.

Australian vulnerability to a Chinese slowdown has been underscored in recent weeks by a slide in iron ore prices. Iron ore and concentrates accounted for about 25 percent of Australia’s merchandise trade with China in 2018, followed by coal, natural gas and gold.

From a recent five-year high of $US125.77 on July 7, iron ore’s benchmark price slid below $US100 a tonne this week. This is down more than 20 per cent - a technical bear market in the commodity.

A weaker Chinese currency is bad news for Australian services providers in the education and tourism sectors. Universities are already reporting a fall-off in Chinese student numbers.

On the other hand, a weakening Australian dollar – it has been trading around 67-68 US cents - will be helpful to commodities exporters. Australian dollar weakness is the most pronounced since the global financial crisis.

Impact

In its latest World Economic Outlook statement the International Monetary Fund warned of softening global growth. This is already the lowest since the global financial crisis of 2008.

It warned that “missteps’’ in trade tensions between the US and China, coupled with a messy Brexit, would further impact global growth in an environment where risks are very much to the downside.

The IMF shaved a 0.1 percentage points from its April growth projections for 2019 and 2020 to 3.2 per cent and 3.5 per cent respectively. A global expansion of 3.3 per cent, or lower, would be the weakest since 2009.

What should be more concerning for a trading nation like Australia is the IMF’s forecast of a sharp reduction in global trading volumes in goods and services. It reduced its growth estimates by nearly a full percentage point to 2.5 per cent in 2019.

Weakness in China should also be worrying from an Australian budgetary perspective. Second quarter Chinese GDP released last week showed a deceleration to 6.2 per cent. This is the weakest expansion since quarterly data began in 1992.

Australian officials are attempting to sound the alarm – without being alarmist -- over a deteriorating trading environment made worse by idiosyncratic US policymaking.

“We shouldn’t overreact to these developments but we should recognise that China’s currency moves and the increase in US tariffs are an unwarranted escalation,’’ Treasurer Josh Frydenberg told ABC radio.

“Right now, the Australian government would like to see cool heads prevail.’’

American policy these days is anything but cool. Trade policy appears to be driven significantly by a president’s mood swings – between optimism that a trade deal with China is in sight and unhappiness Beijing is not being more accommodating to his demands.

Thus, Trump was upbeat following a bilateral meeting with China’s President Xi Jinping at the Osaka G20 summit in June but downbeat last week when trade negotiations appeared to have stalled.

These uncertainties are roiling equities markets at a time when worries more generally about global leadership are fraying investors’ nerves and casting further doubt on even the most downbeat forecasts about global growth.

Australian economic forecasters see little early respite from global economic instability as long as the US and China seem bent on a trade collision.

Andrew Charlton, an independent economic strategist and previously economic adviser to Prime Minister Kevin Rudd, made the good point it was difficult to have much confidence in the economic outlook when uncertainties are driven as much by geopolitical factors as those relating to economic realities.

“Markets have been spooked because they’ve been forced to recognise there is little prospect of a quick deal to end the trade dispute,’’ Charlton said.

“It’s harder to see a rational economic outlook when part of the cause of this dispute is geopolitical.’’

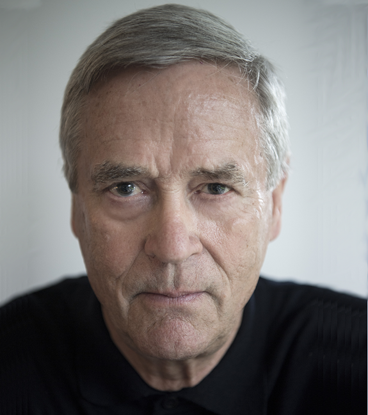

Tony Walker is a bluenotes contributor, former Financial Times correspondent in China and former Australian Financial Review political editor.

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

editor's picks

11 Jun 2019

Waiting on China’s ascendance

Richard Yetsenga |

02 Aug 2019

International education in Australia: more than just China

Hayden Dimes, Bansi Madhavani & David Plank |

04 Jul 2019